Business Performance

Business performance requires a disciplined approach to all activities conducted in the day to day operations of a business. The easiest methodology is the Porters model, 30 years old but it still accurately depicts the processes and activities that are carried out in a business today.

Business performance is about changing the processes within a business to more effective and efficient methods. This is typically a change management program where the activities and procedures must be created to drive a performance shift within a business.

When we look at business, any business, the activites carried out fall under the following headings.

Firm Infrastructure

Human Resources

Health & Safety

Technology and Development

Procurement

Accounts

Operations

Sales and Marketing

Owner Involvement

This categorization of activaites helps to stream line gap analysis. Gap analysis is used to identify where there are opportunities for business improvement, once the opportunities are identified they can be prioritized and actioned to provide deliverable measurable results.

Where does your Company have Opportunities for Improvement?

Take a pencil and draw out the key activities in each of the streams identified in the Porters Model, is there any area where you know you have not applied the required focus to obtain the best results? Lets take a look at a quick example, we start with the high level and drill down to one aspect of the process, then we can identify the activities to improve the situation.

- Firm Infrastructure

- Accounts

- Accounts Receivable

- Late Payments

- % of late payments to revenue / late payment days outstanding / historical data

- Worsening

- Implement strategies to reduce late payments

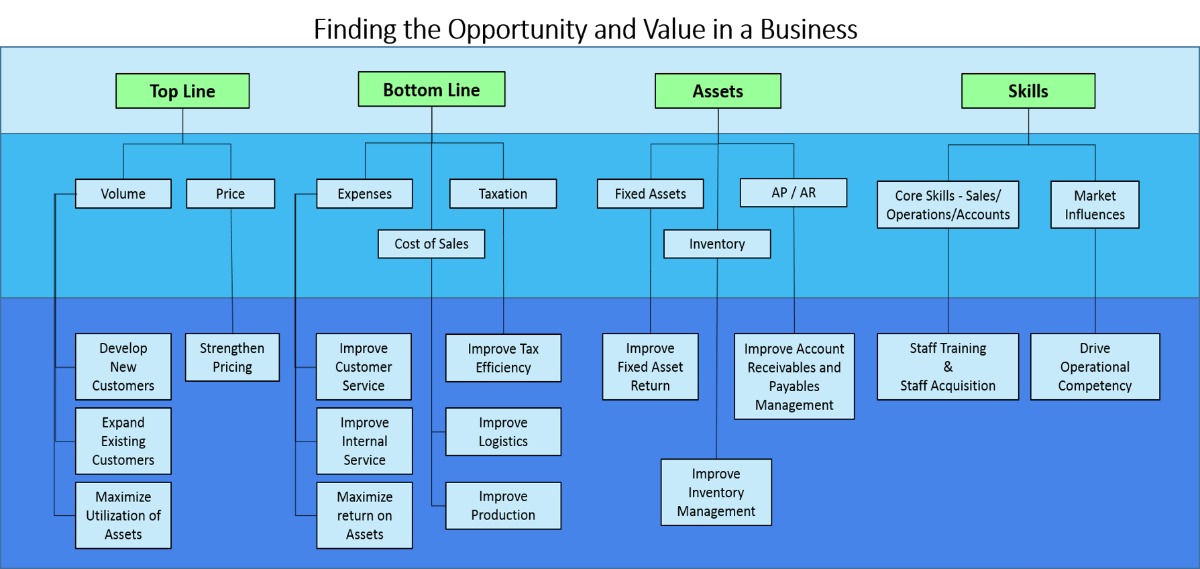

Looking at a business from a high level to identify how you can generate Growth and Value

This is a model for interpreting, at a very high level, the impact that various aspects of your business have on producing growth and value.

It is often said that the easiest dollar that you can make is a dollar saved, this references the fact that $1.00 saved increases EBITDA by $1.00, the mirror to this situation is that a $1.00 increase in sales will only increase EBITDA by typically 0.10 cents. So in order to make a $1.00 impact on EBITDA you must increase sales by $10.00. Unfortunately many business make the mistake of reducing cost past the point where it affects the quality of service and the quality of products. While this does provide a short term benefit it will typically lead to the demise of business value as customers migrate to the better value offering.

Take your time to look through the following model and see if it helps to focus your thoughts on where additional growth and value activities may be in your business.